Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX) is on track to complete its first gold pour in Q4/23 at its Tuvatu project, which could become a "long-lived, high-grade, relatively low-cost underground mine," reported ROTH Capital Partners analyst Mike Niehuser in a September 11 research note.

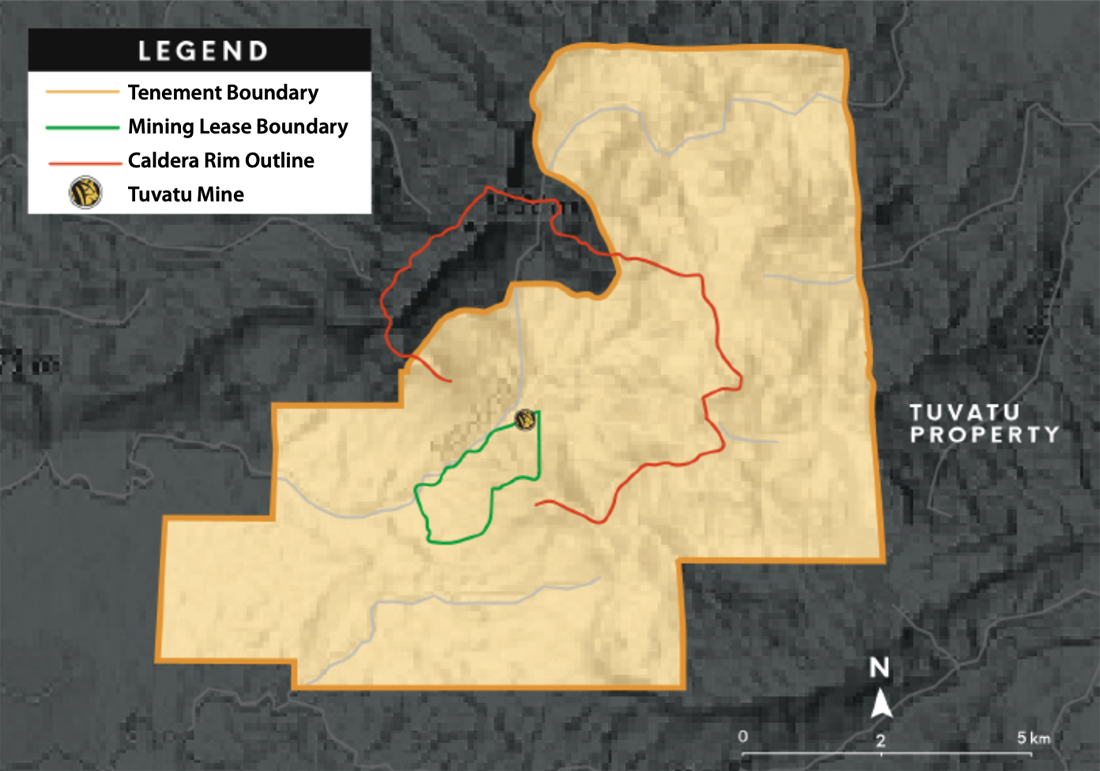

As an alkaline gold system, this project on Fiji "has the potential to grow into a multimillion-ounce gold resource," Niehuser wrote. "In addition, given the proximity and numerous positive characteristics, Lion One's position in the Navilawa caldera could match or better Fiji's Vatukoula gold mine, with an 11,000,000-ounce (11 Moz) deposit and an 85-year operating history."

175% Gain Implied

As such, ROTH maintained its target price of CA$2.50 per share on the near-term producer, currently trading at about CA$0.91 per share, noted Niehuser.

The difference between these two prices implies a significant potential return for investors of 175%.

Lion One is a Buy.

Production Numbers

Niehuser provided a loose timeline for Lion One's production increases at Tuvatu.

Currently, the Canadian company has nearly completed construction of the Tuvatu underground mine, is stockpiling ore, and is about to begin commissioning. It aims to start and maintain production there at 300 tons per day (300 tpd) over the first 18 months, then increase it to 500 tpd in mid-2025, Niehuser reported.

Lion One then could boost production further, thanks to successful exploration work, to about 1,000 tpd (1 Ktpd) in 2026 and 1.25 Ktpd in 2028.

"This will result in the cumulative production of approximately 1 Moz over ten years," Niehuser indicated.

Potential for Growth, Acquisition

Niehuser highlighted that while developing the mine, Lion One has found additional prospective structures that could ultimately expand the existing resource. These include the URA1 lode and 1 kilometer to the north of Tuvatu, the Lumuni vein outcrop, which has yet to be fully tested for mineralization.

Lion One did, however, recently complete 14 new CSAMT, or controlled source audio-frequency magnetotellurics, lines to supplement the previously performed surveys. Data from this effort are expected soon.

"Beyond Tuvatu, given exploration results on the existing mining concession and within the Navilawa caldera, we believe that there is the potential for an additional three to four Tuvatu-like prospects," added the analyst.

Also, Niehuser purported, in the future, the overall Tuvatu project and mine could become a potential takeout target, likely for a major gold producer.

| Want to be the first to know about interesting Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Lion One Metals Ltd. is a billboard sponsor of Streetwise Reports.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

Disclosures for Roth, Lion One Metals Ltd., September 11, 2023

Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

Disclosures: Shares of Lion One Metals Limited may be subject to the Securities and Exchange Commission's Penny Stock Rules, which may set forth sales practice requirements for certain low-priced securities. Within the last twelve months, ROTH Capital Partners, or an affiliate to ROTH Capital Partners, has managed or co-managed a public offering for Lion One Metals Limited. Within the last twelve months, ROTH Canada, an affiliate of ROTH Capital Partners, has received compensation for investment banking services from Lion One Metals Limited.

ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months. The material, information and facts discussed in this report other than the information regarding ROTH Capital Partners, LLC and its affiliates, are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. Additional information is available upon request. This is not, however, an offer or solicitation of the securities discussed. Any opinions or estimates in this report are subject to change without notice. An investment in the stock may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Additionally, an investment in the stock may involve a high degree of risk and may not be suitable for all investors. No part of this report may be reproduced in any form without the express written permission of ROTH. Copyright 2023. Member: FINRA/SIPC.